These elements need to be defined and initialized in order to build and backtest a strategy. In the quantstrat backtesting infrastructure, each strategy runs on a specific portfolio and account. Then we define the stock metadata using the stock() function from the FinancialInstrument package. Loading quantstrat causes these other libraries to be loaded automatically:įirst, we specify the symbols and currencies that we are using. # The search command lists all attached packages. Load the Quantstrat Package in R #Load quantstrat in your R environment. We will use the QQQ ETF that tracks the Nasdaq 100 Index, as the instrument and over it we will overlay 10-period EMA and 30-period EMA to observe the crossover.

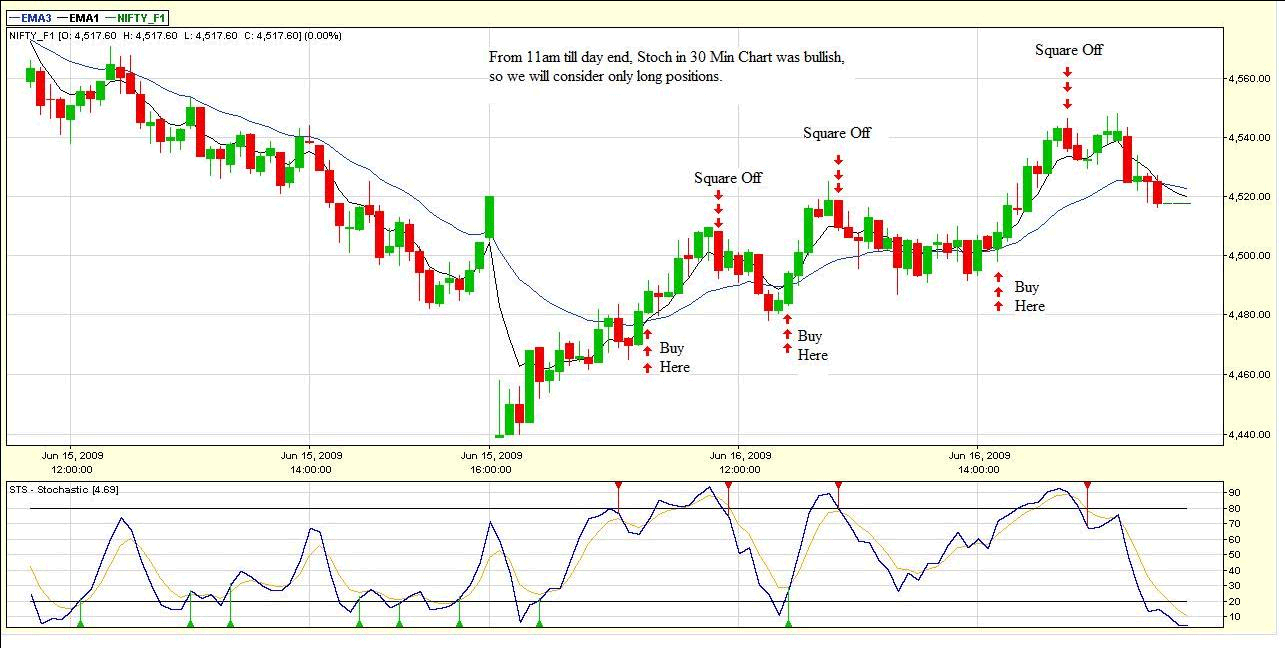

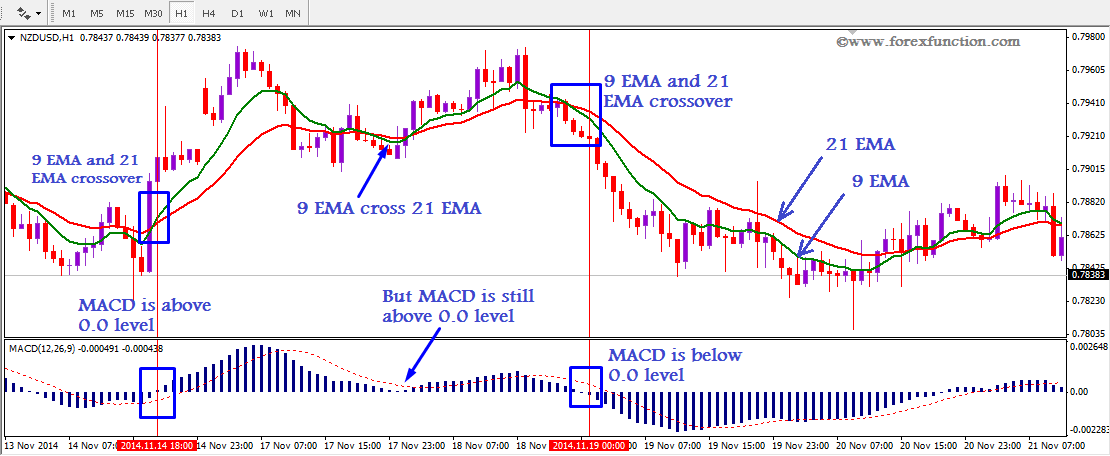

To start building our EMA Crossover strategy, we will first define some variables that the strategy will use, as well as get the historical data for the symbol. Notice how the short-term average crossing the long-term average signals the beginning of an uptrend. In the below chart, the red line represents the 10-period moving average and the blueline represents the 20-period moving average. A bearish crossover occurs when the shorter moving average crosses below the longer moving average.A bullish crossover occurs when the shorter moving average crosses above the longer moving average.5-day EMA and 35-day EMA would be deemed short-term, while a system using a 50-day SMA and 200-day SMA would be long-term.

20 ema crosses 200 ema series#

They also form the building blocks for many other technical indicators and overlays, such as Bollinger Bands, MACD and the McClellan Oscillator. Despite this lag, moving averages help smooth price action and filter out the noise. Note that moving averages do not predict price direction, but define the current direction with a lag (because of basing on past prices). Exponential Moving Average shows the average value of the underlying data, most often the price of a security, for a given time period, attributing more weight to the latest changes and less to the changes that lie further away. The 12- and 26-day EMAs are the most popular short-term averages.

This type of moving average reacts faster to recent price changes than a simple moving average. Once the day-to-day fluctuations are removed, traders are better able to identify the true trend and increase the probability that it will work in their favor.ĮMA refers to Exponential Moving Average. Moving averages smooth the price data to form a trend following indicator (TFI). Moving AveragesĪ moving average is the average price of a security over a set amount of time. Let’s briefly review what moving averages and crossovers are. Our first quantstrat example case study is based on the Exponential Moving Average (EMA) Crossover.

0 kommentar(er)

0 kommentar(er)